Discover the powerful features that make our

Loan Origination Software the preferred choice for lenders

Automated Workflow

Eliminate manual processes with automated workflows that

speed up the loan origination process.

Document Management

Efficiently collect, store, and manage all necessary documents within a secure digital environment.

Customizable Underwriting

Tailor underwriting criteria to match your specific lending policies and risk tolerance.

Compliance and Reporting

Stay ahead of regulatory requirements with built-in compliance tools and comprehensive reporting capabilities.

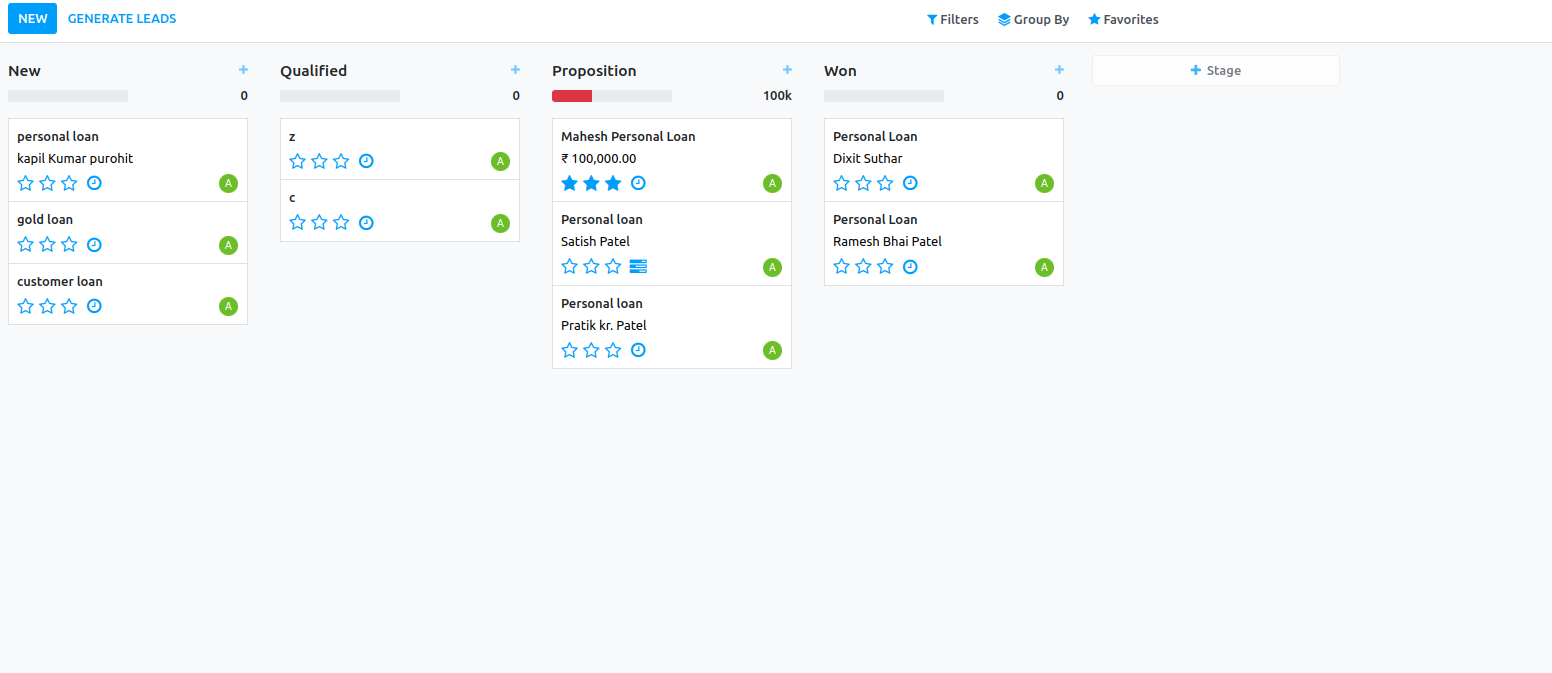

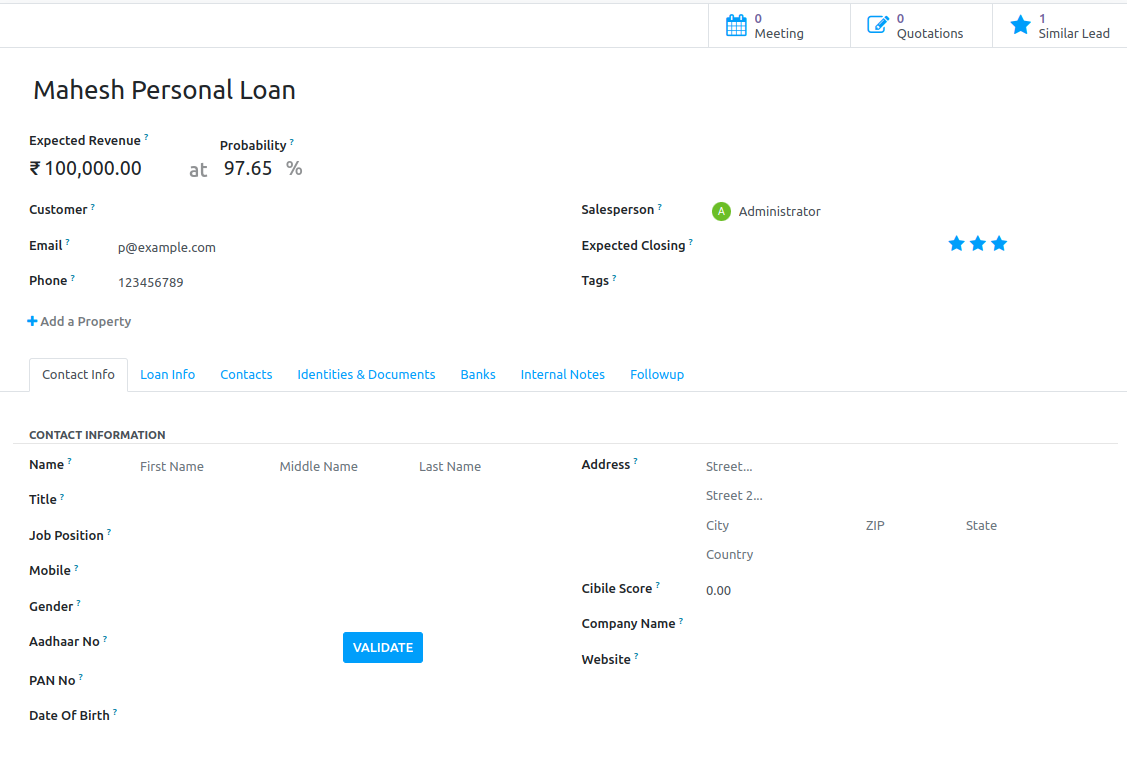

Loan CRM

Get customer history and analytics using smart filters. Track leads, close opportunities and get accurate forecasts.

Lead Creation

Add Activity

Forecast and MIS reports.

Document Verification

Sales Team

Optimizing the Borrower Journey

Lead management is key to optimizing the borrower journey from initial contact to loan approval. By providing timely and relevant information, financial institutions can build trust and foster strong relationships with potential borrowers.

Timely Interventions

Consistent Engagement

Integrated Systems

Optimizing Workflow Efficiency

The activity scheduler in our loan management software enhances workflow efficiency by enabling users to schedule and manage tasks effectively. It ensures that all critical activities related to loan processing and customer interaction are systematically organized and executed.

Task Prioritization

Calendar Integration

Automated Reminders

Enhancing Customer Engagement

The activity scheduler in our loan management software enhances customer engagement by ensuring timely and personalized interactions throughout the loan lifecycle. It facilitates proactive communication and relationship-building efforts, thereby improving customer satisfaction and loyalty.

Customer Communication

Task Collaboration

Feedback Collection

Enhancing Loan Conversion Rates

A robust lead management system helps improve loan conversion rates by ensuring that no potential borrower falls through the cracks. It enables financial institutions to prioritize and focus on high-potential leads, ultimately boosting loan approvals.

Lead Prioritization

Personalized Communication

Centralized Lead Database

Frequently Asked Questions (FAQs)

Loan Origination Software (LOS) is a system designed to manage the entire loan application process from initial inquiry through to loan approval and disbursement. It automates various steps, including application processing, credit checks, document collection, underwriting, and approval workflows, making the lending process more efficient and user-friendly.

Our LOS streamlines the loan application process by automating repetitive tasks, integrating with credit bureaus for quick credit checks, managing documents digitally, and providing customizable workflows for underwriting and approvals. This leads to faster processing times, reduced manual errors, and improved customer satisfaction.

Yes, it seamlessly integrates with popular CRM systems for unified customer and loan management.

Our LOS employs robust security measures like data encryption and access controls to safeguard sensitive information.

Yes, our LOS supports customizable multi-level approval workflows, ensuring efficient and transparent decision-making processes.

"Let our LOS be the beginning of your smoother, faster lending journey. Upgrade today and watch your loan origination process flourish like never before!"