Comprehensive Loan Management System

Personal Loan

Solve personal loan needs with software. We design architecture,

integrate for advanced features, then build, test, and deploy your

dream solution.

Vehicle / EV Loan

Streamline

your vehical loa workflows by integrating apps and systems with AI data

sync (middleware, APIs) for real-time collaboration.

Gold loan

Simplify business operations with tailored or implemented AI-powered

Gold Loan for real-time process efficiency, custom development, and ongoing

support.

Customers

Easy view of customers, filters, and creation features with Family & Contacts details, Identities & Documents, and Bank Accounts. Easily manage customer data.

Able to upload Documents

Able to add nominee contacts

Able to get ledger report.

User-friendly view

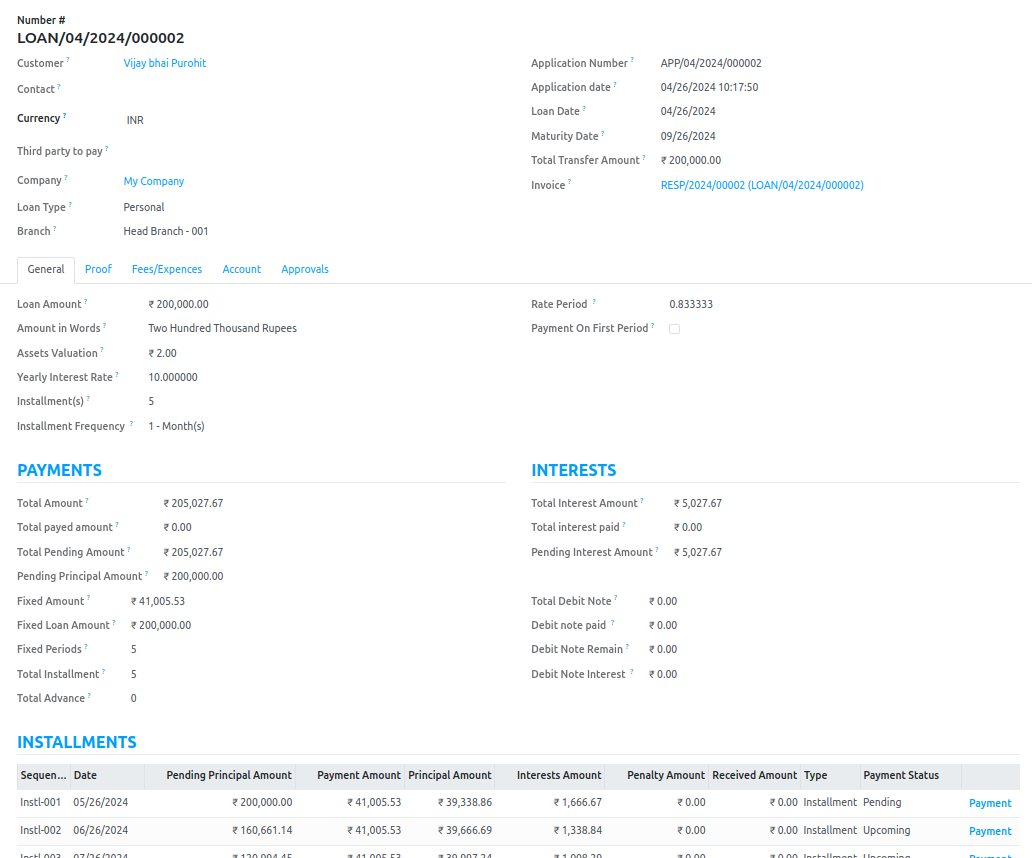

Loan Portfolio

Loan Management System with approvals, with diff Type of Products, Accounting, Total Paid Amount, Total Pending Amount, Pending Principal Amount, Total Interest Amount, Total Interest Received and Pending Interest Amount.

Auto calculated table

Process charges

Cancel loan

Advance Payment

Schedules

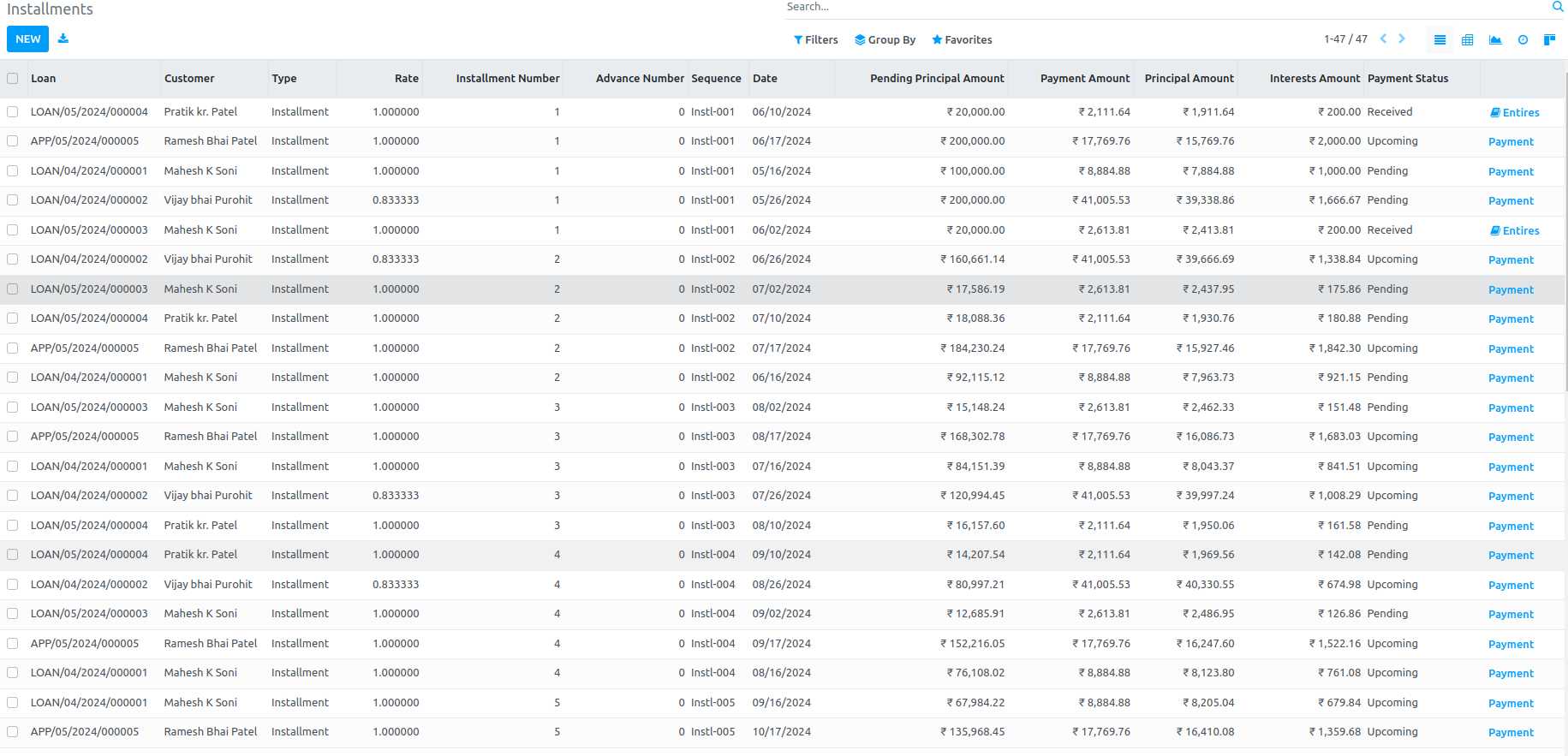

Installments with computation, Pending Principal Amount, Payment Amount, Principal Amount, Interest Amount, Penalty Amount and Received Amount. Installment managed easily and related payments with penalty.

Easy to Filter

Custom Group By

Payment Management

Easy MIS Report

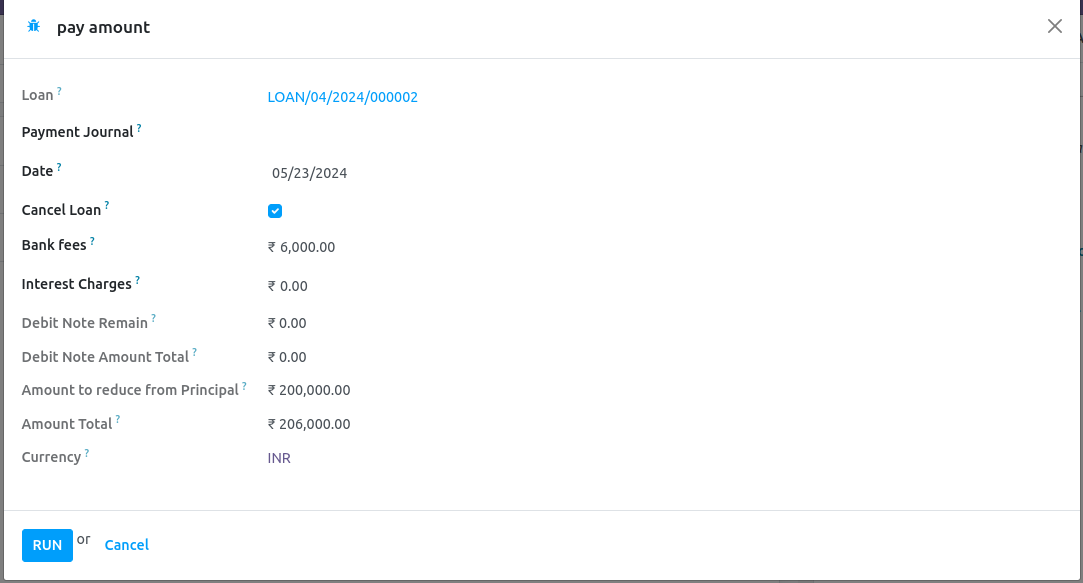

Loan Cancellation

Record employee Our loan management software offers a flexible loan cancellation feature, giving customers control over their loan agreements. This feature is designed to provide peace of mind and support to borrowers who may need to cancel their loans.

User-Friendly Interface

Immediate Processing

Detailed Cancellation Policy

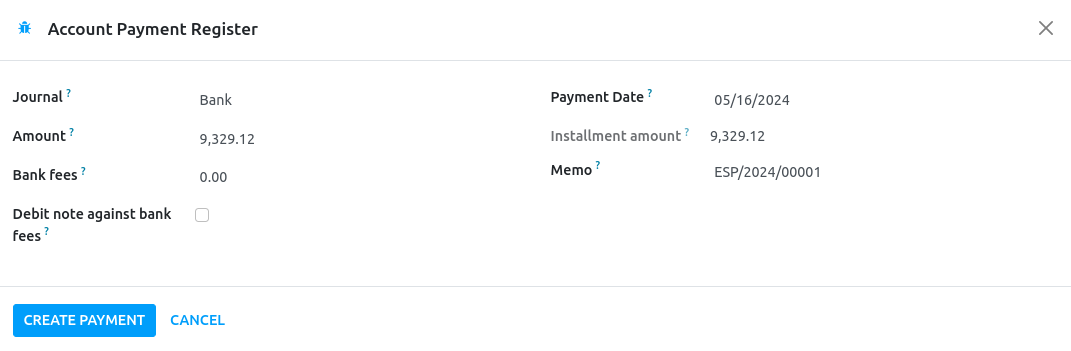

Repayment Process

Ensuring transparency and security in repayment transactions is paramount in our loan management software. We prioritize the safety of financial transactions and provide borrowers with clear, detailed information regarding their repayment obligations.

Secure Payment Gateway

Transaction Monitoring

Receipt and Confirmation

Get Customer's Credit score report By

Frequently Asked Questions?

A loan management system is a software solution designed to manage the entire loan cycle efficiently. With the CredMent LMS, you can accelerate your market launch, create consumer-friendly lending products, and ensure compliance with local and international regulations throughout the process.

A loan management system offers numerous advantages. It simplifies your lending process with automatic credit checks, precise customer assessments, and a fully online, paperless workflow. Additionally, it enhances efficiency by streamlining the entire lending process.

Implementing a loan management system can seem daunting at first, but today's systems are designed for ease of use right from the start. You can quickly reap their benefits without extensive setup. Furthermore, since most systems are cloud-based and provide real-time support, installation is fast, and any issues are promptly addressed, saving you time and effort.

Modern Loan Management Systems arrive with seamless integrations, which allow for a seamless and effortless transition from a legacy system to a modern loan management system. Along with this, most companies offer onsite installation and integration support, meaning you can sit back and relax while the experts upgrade your system and migrate your entire loan portfolio to a system designed for the customers of tomorrow.

While the core principles of lending institutions remain consistent, we recognize that every business has unique needs. CredMent's LMS offers extensive customizations alongside its core features. Connect with our business executive today to discuss how our solutions can meet your specific requirements.

The timeline for implementing a modern loan management system and transferring your entire portfolio from a legacy system typically varies based on specific requirements, ranging from 1 to 5 business days.

"Transform your loan management with precision and ease. Empower your business with our advanced LMS today!"